The customer shops and chooses the item on the website and click on "Pay Now" to make the payment.

As soon as customer click "Pay Now" button, he/she is sent to the Signetpay's payment page, where he/she selects his/her mode of payment and provides the details.

Further, Signetpay sends the details collected from the customer to the bank.

Payment's success or failure notifications are shown on the merchant's website.

Signetpay takes customer back to the merchant's website with information about his / her transaction status.

In the last step, the bank verifies the customers and lets him / her know about the status of his transaction.

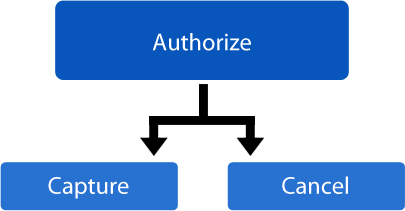

The first step of payments flow is Authorization. Here, the customer is authorized and the amount to be paid (by using debit/credit card) is blocked on his/her card for the maximum time period of 8 days, by the bank.

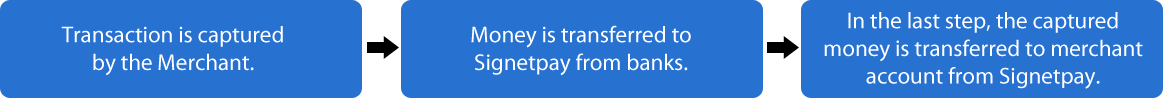

The second step of payment involves capturing the payment, i.e. the money which has been blocked during the Authorization process, is transferred to the merchants account from the bank. The merchant can capture the transaction in up to 5 days after the Authorization.

The merchant can cancel the authorized transaction, and in this scenario the money on the customer's card which was blocked during the authorization step is released.

In some cases, a merchant might have to refund the captured amount, this is where the refund process comes to an action. By using this procedure, the merchant can refund the captured money either in full or a partial amount.

There are few cases where a customer opposes the transaction, and asks for his/her money back. The customer can claim back his money from up to 180 days after the transaction is done. Proofs for the claim are submitted by the customer as well as by the merchant to the bank.